Costco is one of the largest retailers globally with 625 stores in the U.S. and 136 million members worldwide. The company is always looking for new ways to make shopping more convenient and flexible for its customers. Recently, Costco announced a new payment plan option in partnership with Affirm, available exclusively to its members. This exciting launch comes at the perfect time, especially with Memorial Day just around the corner—a period when many customers are actively shopping for seasonal deals, electronics, and home upgrades. With this new financing option from Affirm, shoppers now have the flexibility to take advantage of Memorial Day deals and discounts at Costco while spreading the cost over time. Whether planning a big-ticket purchase or stocking up on essentials, members can enjoy more freedom and financial control as they shop their favorite deals.

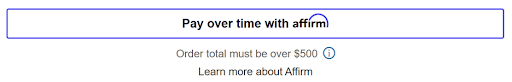

This flexible payment method is now offered for all eligible online purchases over $500. Whether you’re shopping for the latest tech, refreshing your wardrobe, or upgrading your home essentials, Affirm makes it easier to pay over time.

Affirm is considered an industry leader in the buy now, pay later (BNPL) space.

What Is Buy Now, Pay Later (BNPL)?

BNPL is a modern financing option that allows customers to split their purchases into smaller, manageable payments. Customers can select a payment plan that suits their budget and enjoy the flexibility of spreading payments over time.

How Affirm works on Costco website:

- Shop Online: Add $500 of more of eligible items to your Costco.com cart

- Proceed to Checkout: When you’re ready to pay, select Select Affirm as your payment method at checkout on Costco.com

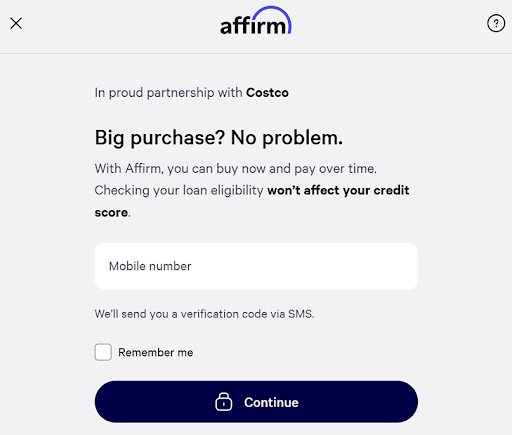

- Enter some basic information for a real time decision. This won’t affect your credit.

- Pick a payment plan of your choice. Currently, 3-36 months payment options are available.

- Complete Your Purchase and Pay overtime in affirm app or affirm.com: Your order is confirmed, and you’ll pay in installments according your selected schedule. Affirm gives an option to also setup automatic payments.

How affirm works?

- Goto your Cart and click on “Checkout”

- Click pay over time with affirm

Verify your mobile number and enter your details to continue

Benefits of Using Affirm:

- Budget-Friendly: Split large payments into smaller payments and spread the cost over time to fit your budget.

- Quick and Easy Approval: Soft credit checks only; approval takes seconds.

- Transparent Payments: No hidden fees, late fees, or fine print.

- Flexible payment options: Start enjoying your purchase now and pay later in 3-36 months.

Tips for Using Affirm Responsibly

- Track Your Payments: Set reminders to avoid missed payments.

- Understand the Terms: Some Affirm plans may charge late fees or interest if payments are missed.

- Budget Accordingly: Only use Affirm for purchases you can afford to repay.

Alternate Payment Options for In-Store Shoppers The Affirm partnership expands the range of flexible payment options available to Costco customers, starting with online purchases. While Affirm is currently only available for eligible online transactions, members interested in financing in-store purchases still have excellent alternatives. You can take advantage of installment options by using the Costco Anywhere Visa® Card by Citi, which offers valuable rewards and exclusive benefits. Additionally, other Visa cards issued by banks that support payment plan programs may provide similar flexible financing. These alternatives ensure you have multiple ways to manage your spending and make the most of your Costco membership—whether you shop online or in-store.

About Citi Costco Card: The Costco Anywhere Visa® Card by Citi provides an excellent array of rewards and benefits, specifically tailored for Costco members. Cardholders can earn 5% cash back on gas purchases at Costco, 4% cash back on eligible gas and EV charging purchases for the first $7,000 per year (then 1% thereafter). Dining and eligible travel purchases—including those made through Costco Travel—earn 3% cash back. All purchases made directly from Costco and Costco.com yield 2% cash back, while all other purchases earn 1%.

The card comes with no annual fee beyond the required Costco membership, and it includes no foreign transaction fees—making it ideal for international travel. Additional perks include extended warranty protection, purchase damage and theft protection, and a suite of travel insurance benefits. Cash back rewards are issued annually as a reward certificate, which can be redeemed for merchandise or cash at any Costco warehouse in the U.S. Furthermore, the card doubles as your Costco membership ID, simplifying your wallet and streamlining the checkout process.

Here is a comparison of Affirm and Citi Costco card payment options for Costco members:

| Citi Costco Card | Affirm | |

| In Store Purchases | Yes. Use Citi Flex Pay to split eligible purchases into fixed monthly payments. | Not available |

| Online < 500 | Yes. Use Citi Flex Pay to split eligible purchases into fixed monthly payments | Not available |

| Online > 500 | Yes. Use Citi Flex Pay to split eligible purchases into fixed monthly payments | Yes. Payment option is available at point of sale for online transactions. |

Citi Flex pay can be selected for transactions in the Citi account. It is not available at the time of purchase.]

Security and Trust

Costco and Affirm are committed to maintaining the highest standards of data security and customer privacy. Every transaction you make is encrypted and monitored using advanced technologies to ensure your personal and financial information remains secure. From checkout to the final payment, your data is protected every step of the way, giving you peace of mind while you enjoy the benefits of flexible financing.

Happy shopping!

//////////=================///////////////////