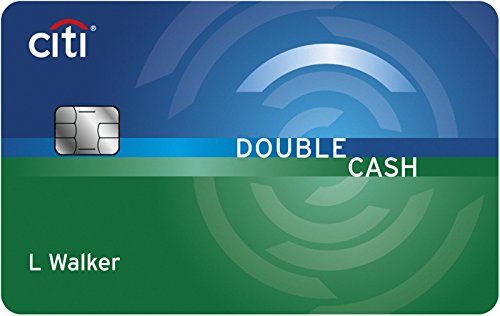

Citi® Double Cash® Card

| 13.99% – 23.99% Variable | 0% for 18 months on Balance Transfers |

|

– |

|

$0 |

on Citibank secure site

on Citibank secure site

| 13.99% – 23.99% Variable | 0% for 18 months on Balance Transfers |

|

– |

|

$0 |

on American Express secure site

on American Express secure site

| 15.99% - 22.99% Variable | - |

|

Earn 75,000 Membership Rewards Points after you spend $4,000 on purchases on your new Card in your first 6 months. |

|

$250 |

on American Express secure site

on American Express secure site

| 0% intro APR on purchases for 12 months from the date of account opening, then a variable APR, 13.99% to 23.99%. | - | Plan It® gives the option to select purchases of $100 or more to split up into monthly payments with a fixed fee. |

Earn $300 Back after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership. You will receive the $300 back in the form of a statement credit. |

|

$95 |

on American Express secure site

on American Express secure site

| 0% intro APR on purchases for 15 months from the date of account opening, then a variable APR, 13.99% - 23.99% | - | Plan It® gives the option to select purchases of $100 or more to split up into monthly payments with a fixed fee. |

Earn a $150 statement credit after you spend $1,000 or more in purchases with your new Card within the first 3 months of Card Membership. |

Unlimited 1.5% Cash Back on your purchases. |

$0 |

on Bank of America secure site

on Bank of America secure site

| 0% intro APR on purchases for 15 months from the date of account opening, then a variable APR, 13.99% to 23.99%. | 0% for 15 months on Balance Transfers | No annual fee and cash rewards don’t expire. |

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening |

|

$0 |

on Capital One secure site

on Capital One secure site

| 0% intro APR on purchases for 15 months from the date of account opening, then a variable APR, 15.49% to 25.49%. | 0% for 15 months on Balance Transfers | No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn |

One-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening. |

Earn unlimited 1.5% cash back on every purchase, every day. |

$0 |

on Capital One secure site

on Capital One secure site

| 17.24% - 24.49% Variable | Receive up to $100 application fee credit for Global Entry or TSA Pre. |

|

Earn 100,000 bonus miles when you spend $20,000 on purchases in the first 12 months from account opening, or still earn 50,000 miles if you spend $3,000 on purchases in the first 3 months. |

Earn unlimited 2X miles on every purchase, every day. |

$95 |

on Chase secure site

on Chase secure site

| 14.24% - 22.24% Variable | - | No annual fee and No foreign transaction fees. |

Amazon Gift Card Bonus will be instantly loaded into your Amazon.com account upon the approval of your credit card application. |

|

$0 |

on Discover secure site

on Discover secure site

| 0% intro APR on purchases for 14 months from the date of account opening, then a variable APR, 11.99% - 22.99% | 0% for 14 months on Balance Transfers | Redeem cash back in any amount, any time. Rewards never expire. |

Unlimited Cashback Match – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300. |

|

$0 |

on Discover secure site

on Discover secure site

| 0% intro APR on purchases for 14 months from the date of account opening, then a variable APR, 11.99% - 22.99% | 10.99% for 14 months on Balance Transfers. | Get your free Credit Scorecard with your FICO® Credit Score, number of recent inquiries and more. |

Unlimited Bonus: Only Discover will automatically match all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match. |

Automatically earn unlimited 1.5x Miles on every dollar of every purchase – with no annual fee. |

$0 |

We provide tools to compare cards and strive to simplify the credit card search process for customers. The offers presented on this site are from our partner companies. Thecardsminer does not offer financial products. All application pages are hosted by issuers who collects and approve or decline applications. Thecardsminer doesn’t ask for customer’s private information on this site and doesn’t make decisions on applications. This site does not include all credit card offers or all credit card companies in the marketplace. Availability of products and offers may impact how and where products appear on this site and under listing categories. Credit card offers and partnerships change over time and offers on this site may not represent the latest offers from the partners. Always check all the terms and conditions from issuers before selecting and applying for a credit card. The content on this site is not provided or endorsed by a credit card issuer.